Present value of minimum lease payments

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. The ClearTax Lease Calculator uses the residual value of the asset to calculate both the monthly lease payments and the total.

How To Calculate The Present Value Of Future Lease Payments

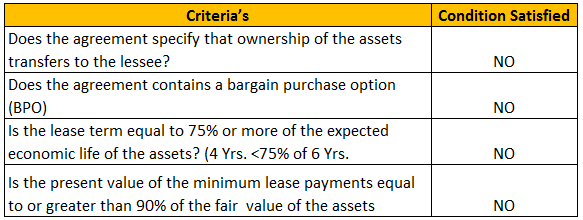

GAAP leases are finance leases if any of four conditions are met.

. Updated July 28 2022. Fixed consideration is a payment made directly for the right to use the underlying asset and is explicitly stated in the lease contract. Our monthly rate is 025 and the present value of all monthly lease payments over 5 years is CU 55 708.

However the asset will obviously be. For example you could use this formula to calculate the present value of your future rent payments as specified in your lease. Depending on the agreement the lessee may be able to make.

The present value of the minimum lease payments required under the lease is at least 90 of the fair value of the asset at the inception of the lease. Lease transactions - Asset leasing supports the initial recognition of the right-of-use asset for leases on the balance sheet as well as subsequent measurement for either on-balance sheet leases or off-balance. Is the present value of lease payments plus RVG residual value guaranteed by the lessee.

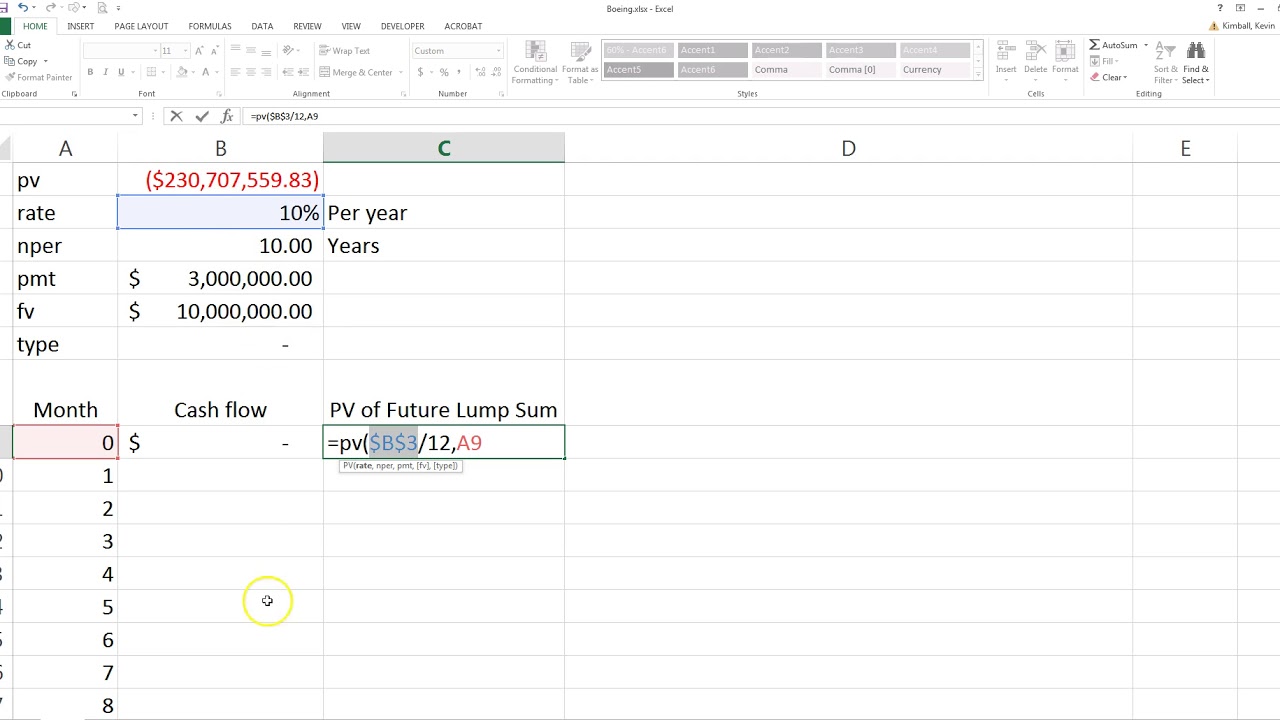

The formula of PV PV P 1 1i-n i Given. For example if the present value of the lease payments amounts to 50000 then 50000 is going to be debited to the relevant asset account whereas the. Distribute the cash received as periodic lease rentals into two parts.

Now that weve explained the different ways accounting principles look at equipment leasing lets answer a few common questions. You would recognize it as. CR Accumulated Depreciation 20624.

The lessor uses the residual value to determine the periodic lease payments the lessee must make on the asset. To calculate it you need to make assumptions about. Accounting for Variable Lease Payments.

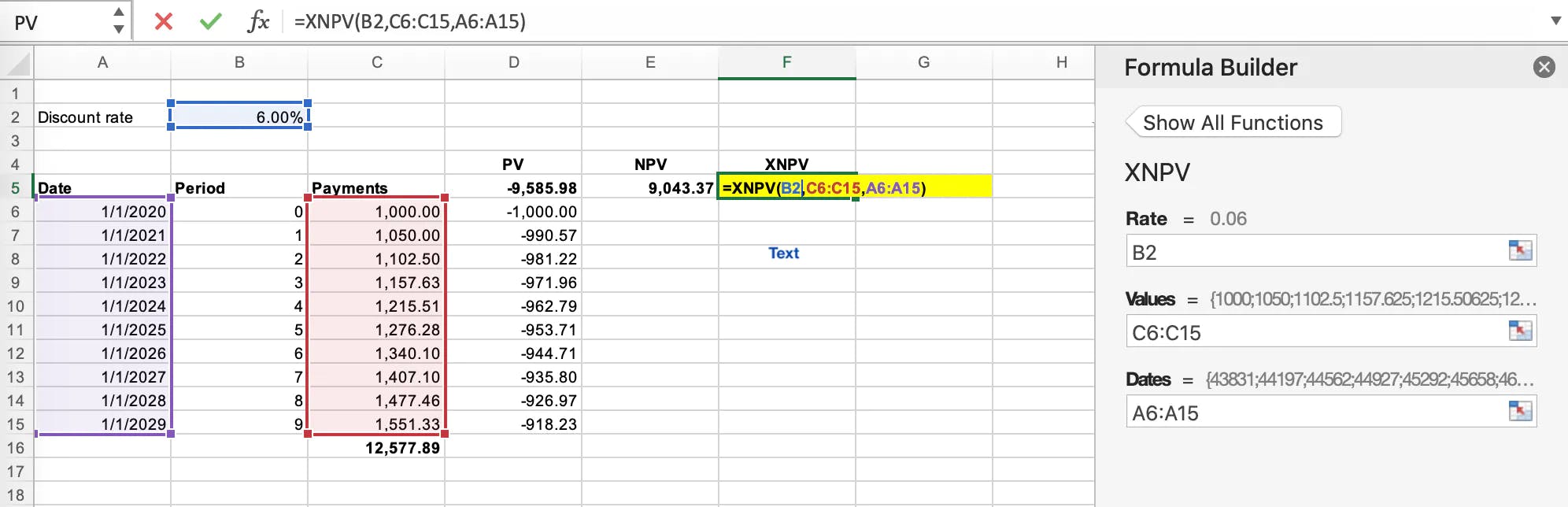

The system also calculates the net present value of future minimum lease payments for the purpose of valuation and classification. Below is an example of using an annuity to solve the above problem. It measures the right-of-use asset at CU40539 being the present value of the lease liability plus the CU5000 lease payment made at commencement.

An equipment lease agreement is between a lessor the owner of the equipment and a lessee who agrees to pay rent for the equipment to use for a specified time period. The system automatically calculates the monthly interest expense on the liability amortization schedule. If a lease agreement contains any one of the preceding four criteria the lessee records it as a capital lease.

The present value of the minimum lease payments totals at least 90 of the fair value of the asset at the beginning of the lease. It holds because the periodicity of the lease payments is typically evenly spaced out. For leases classified as capital lessees perform a calculation to determine the present value of minimum lease payments that is used as a basis for the capital lease asset and liability values.

At commencement of the lease term finance leases should be recorded as an asset and a liability at the lower of the fair value of the asset and the present value of the minimum lease payments discounted at the interest rate implicit in the lease if practicable or else at the entitys incremental borrowing rate IAS 1720. On the other hand a long-term car rental is more like a month-to-month agreement. The likely amounts owed under residual value guarantee.

Significant details relative to the sale will include the length of time the tenant will have the right to occupy the. A car lease usually lasts between 2 and 4 years which means 24-48 payments. The total price goes up only if you choose to keep renting.

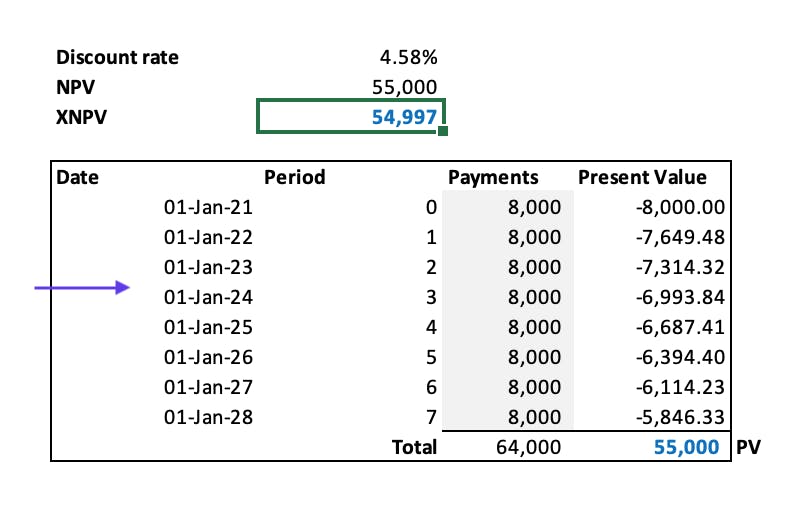

DR Depreciation Expense 20624. The fourth condition requires capitalization if the present value of minimum lease payments MLP is. 2 Calculation of present value PV of min finance lease payments.

Lets suppose if you have agreed to pay 1 of. Calculating present value of future payments Using these assumptions you need to calculate the present value of the minimum future lease payments. Within ASC 840-10-25-6 this standard defines minimum lease payments as the financial obligations that a lessee must make in connection with the leased.

The commercial lease agreement is a notorious real estate form frequently carried out by those who would like to rent space to use for their business interestIt allows the owner of the property and the party interested in buying to record how the tenancy will transpire. For example the present value of the minimum lease payments may approximate to the fair value of the asset at the inception of the final lease and there is unlikely to be an option to purchase the asset at fair value or to extend the lease at a market rent because the asset has reached the end of its life. This is your right-of-use assent and the lease liability at the commencement date.

Fixed and variable consideration. The net investment value is calculated by discounting the minimum lease payments at the implicit interest rate. Because a lease locks you into making those payments for several years the overall cost is predetermined.

Lease liability represents the current value of minimum future lease payments. The lessor and lessee typically agree upon lease conditions in advance that will designate a lease as an operating lease or capital lease. 100 1 1 5 -3 5 27232.

Accounting for a Capital Lease and Operating Lease. Present value of future minimum lease payments As was previously mentioned the straight-line lease expense is calculated as the sum of all payments divided by the lease term. I am assuming that he meant the landlord securing minimum lease payment.

The outcome of the lease analysis is rarely accidental. Annual lease rents P 500000. Calculating the present value of minimum lease payments can also be achieved using an annuity formula.

Lease payments can be separated into two categories. PV of Annuity of Annual Lease Payments. The present value of the minimum lease payments - at the beginning of the lease term - is equal to or greater than 90 of the original fair market value of the equipment.

An equipment lease can be structured with a start and end date or on a month-to-month basis. The present value of the minimum lease payments required under the lease is at least 90 of the fair value of the asset that exists at the beginning of the lease contract. At the end of year two the lease liability is CU33932 being the present value of the eight remaining payments of CU5000.

Payments probable of being owed by the lessee as the result of a residual value guarantee. Lets say you pay 1000 a month in rent. The contract does not require minimum lease payments to equal the.

The discount rate can be the rate implicit in the lease which is the rate where lease payments and unguaranteed residual value are equal to the fair value of the asset and its associated costs for. Present value test.

3 3 Lease Classification Criteria

How To Calculate The Discount Rate Implicit In The Lease

Compute The Present Value Of Minimum Future Lease Payments Youtube

What Is The 90 Threshold For Net Present Value For Determining Whether A Lease Is Finance Or Operating Universal Cpa Review

How To Calculate The Present Value Of Lease Payments In Excel

Capital Lease Criteria Top 4 Step By Step Examples With Explanation

Minimum Lease Payment Overview How To Calculate Example

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Lease Payments In Excel

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Capital Lease Criteria Top 4 Step By Step Examples With Explanation

Impact Of Operating Leases Moving To Balance Sheet

A Refresher On Accounting For Leases The Cpa Journal

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Future Lease Payments